One of the biggest software companies in India, Satyam Computer Services, reports a case of fraud that involved overstating financial statements, showing hugely inflated profits and fictitious assets in the hope of hiding a poor performance. In his letter, Mr Raju said Satyam’s accounts in the quarter ended last September included a cash pile of Rs53.61bn ($1.2bn), of which 94% was “fictitious”.

Among other anomalies, the group’s operating margin was inflated to 24% of revenue compared with an actual figure of 3%, due to mis-stated revenue and profit figures, Mr Raju said. The company had rigged its results over a succession of quarters to show a large operating profit margin, in the range of 20%, versus the actual margin in the September quarter of just 3%.

Satyam’s clients ranged from Unilever and Nestlé to Cisco, GE, Sony and, until recently, the World Bank. Satyam was audited by PwC and was the first Indian company to list on three international stock exchanges – Mumbai, New York and Amsterdam – yet the fraud went unnoticed for years. The fraud is India’s biggest corporate scandal since the early 1990s and its first high-profile casualty since the start of the global financial crisis, with many labelling it the “Indian Enron”.

The news sent shares on India’s stock markets tumbling. And it’s effects are not only immediate but far-ranging: While its revelation will ring alarm bells for hundreds of Fortune 500 companies across the world that entrust their most critical data and computer systems to Indian outsourcing companies and threatens to damage the country’s reputation as a place to do business, the scandal also raises questions over how outsourcing companies are regulated and audited around the world. PwC could face a problematic start of the year as Satyam is listed in the US, where there are legal precedents for auditors held accountable.

The stock market is highly volatile these days and we can hope that such news of financial overstatement will be exposed in the climate of asset liquidation and institutions filing under Chapter 11.

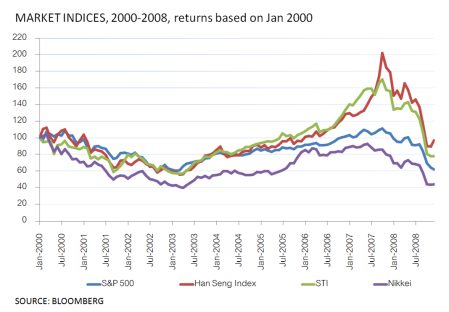

The stock market has always been volatile. In fact, referring to the graph below (click the image to have a clearer version), the stock market price as embodied by major stock indices, exhibits variation that is not only unpredictable but also random in itself. The randomness can be attributed to its susceptibility to news, rumors, political instability and mass panic. The recent Satyam hoo-hah serves to demonstrate the effect such a scandal can have to the stock market; The Mumbai exchange’s benchmark Sensex index fell 7% as shares in Satyam plummeted nearly 80%.

We at Assetton believe in the importance of economic fundamentals and clear-cut rational principles. Our investment-grade wines, contemporary pieces of art from the Baron of Batik, and bankable lands in Canada follow real economic principles. You can be sure that the intrinsic value of these assets is not inflated by tampered financial statement.