With these he expounds financial analysis of wine investment using sound and rational economic principle with modern portfolio theory and capital asset-pricing models using a constructed Fine Wine 50 as an embodiment of the investment-grade wines, not forgetting the risk assessment of fine wine investment.

Winner of the 2006 Gourmand World Media Award for the Best Wine Education Book in the World, Mahesh Kumar’s book has been seminal in the wine market. The book demonstrates the attractiveness of holding a portfolio of fine wine either on its own or as part of a diversified portfolio of traditional financial assets. Mahesh Kumar also adds seven characteristics of a good investment portfolio:

· Investment portfolios must not be too expensive to buy into. This therefore eliminates those multi-million dollar minimum hedge funds.

· Investment portfolios must offer superior returns. The Fine Wine 50 Index offered superior returns unlike money-market funds. On the other hand, this is also characteristic of the FTSE 100 Index and the Dow Jones Index.

· Investment portfolios ought to have low volatility. The RiskGrade™ for the Fine Wine 50 Index is less than that of the FTSE 100 Index and less than that of the DJI. This study demonstrates that a portfolio consisting of Fine Wine and equities has a lower volatility than one consisting of equities and bonds only.

· Investment portfolios must consist of assets that are either uncorrelated or negatively correlated with other assets and states of the economy. The Fine Wine 50 Index has a very low correlation with the FTSE 100 Index, the Dow Jones Index, the UK Government Bonds Index, and with the US 30 Year Treasury Bonds Index, thereby offering significant diversification benefits.

· Investment portfolios should require very little active management and still deliver superior returns. Fine Wine can be held in storage at a cost for a number of years whilst appreciating in value, unlike those mutual funds that change direction whenever its manager changes.

· Investment portfolios should consist of assets that have low transaction and associated costs. Fine Wine does have additional transaction and incidental costs but these are often offset by substantial tax advantages or currency exchange fluctuations.

· Investment portfolios should be tax-free or at least tax-efficient. Fine Wine investment is tax-exempt, offering significant cost savings; unlike traditional financial investments that often attract income and capital gains tax. In the United States, Capital Gains Taxes may apply subject to record keeping and the markets in which the wine is purchased and sold.

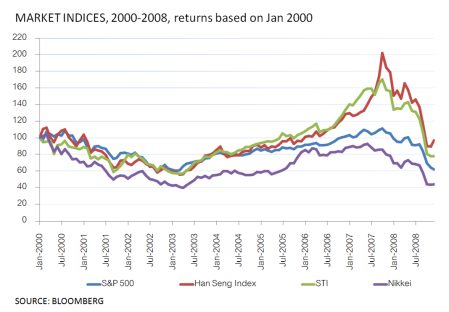

To justify this, wine has shown little or negative correlation with the stock market indices, with lower price volatility. Over the 8 year course, as shown in the graph below (click the picture for a clearer view), the Liv-ex index that is composed of the premier 100 investment-grade wines, has shown little comovement or correlation with the major stock market indices. In fact, Liv-ex 100 Fine Wine Index does not move with S&P 500 Index. This characteristic of fine wine is particularly beneficial for significant risk diversification of your portfolio as shown in Mahesh Kumar’s book.

This is also stated by the recent Liv-ex Monthly Market Report; the wine market, defying the odds encountered by the global economy in the recent months, has shown resilience and greater potential. Despite the extended break, trade in December was surprisingly strong, at just 1% below November’s level (traditionally a far busier month) and 124% up on last year, in comparison to the FTSE 100, S&P 500 and Nikkei 225, all of which has decreased by at least 30%.

More specifically, Bordeaux continued its landslide dominance of the Wine Exchange. From the table below (from Liv-ex) we can see the market power of the Bordeaux brand, with an increase in market share over the year and over the previous month. What better way to diversify your portfolio than investing in the best Bordeaux produce!

Assetton incorporates the investment fundamentals which Mahesh Kumar has laid out in his influential book, into our investment strategy. We provide high-quality advisory on investment-grade wines from the premier region Bordeaux. We offer wine as an investment tool that is hassle-free, tax-free, and has the potential to make your portfolio risk-free. Benefit from the significant risk decrease fine wine can give you by emailing us at info@assetton.com.

Source: Mahesh Kumar’s Wine Investment for Portfolio Diversification, Fine Wine Investment website, Liv-ex Market Report