Wednesday, January 14, 2009

Coming back to the basics

In this article from the Financial Times, the chief of the JPMorgan Chase has announced uninviting prospects in the year ahead. Mr Dimon has predicted deterioration of the economy in 2009, with the rising worry that shares on both sides of the Atlantic will have fallen, that banks might need more capitalization and consumer retail will sag further. JPMorgan, which has fared better than its rivals, has just reached break-even in its 4th quarter results.

Mr Dimon has told the FT that JPMorgan was prepared for an expected deterioration in consumer-oriented businesses but added that if things were to get worse than expected it would have to cut costs again. He further added that the bursting of the credit bubble would force the banking industry to refocus on its traditional businesses of advising on deals and lending to companies and individuals.

With the current state of affairs, more and more industries are going back to the fundamentals of economic principles. We at Assetton have always believed in the value of REAL PHYSICAL INVESTMENTS that follow REAL ECONOMIC PRINCIPLES that yield REAL SUSTAINABLE RETURNS. We offer the best wine, art and land investments that will give you the safest and timeless investment vehicles that ensure no such deterioration that banks and indices report these days.

Wednesday, January 7, 2009

Satyam Computer Services scandal/Why you should look farther than the stock market

One of the biggest software companies in India, Satyam Computer Services, reports a case of fraud that involved overstating financial statements, showing hugely inflated profits and fictitious assets in the hope of hiding a poor performance. In his letter, Mr Raju said Satyam’s accounts in the quarter ended last September included a cash pile of Rs53.61bn ($1.2bn), of which 94% was “fictitious”.

Among other anomalies, the group’s operating margin was inflated to 24% of revenue compared with an actual figure of 3%, due to mis-stated revenue and profit figures, Mr Raju said. The company had rigged its results over a succession of quarters to show a large operating profit margin, in the range of 20%, versus the actual margin in the September quarter of just 3%.

Satyam’s clients ranged from Unilever and Nestlé to Cisco, GE, Sony and, until recently, the World Bank. Satyam was audited by PwC and was the first Indian company to list on three international stock exchanges – Mumbai, New York and Amsterdam – yet the fraud went unnoticed for years. The fraud is India’s biggest corporate scandal since the early 1990s and its first high-profile casualty since the start of the global financial crisis, with many labelling it the “Indian Enron”.

The news sent shares on India’s stock markets tumbling. And it’s effects are not only immediate but far-ranging: While its revelation will ring alarm bells for hundreds of Fortune 500 companies across the world that entrust their most critical data and computer systems to Indian outsourcing companies and threatens to damage the country’s reputation as a place to do business, the scandal also raises questions over how outsourcing companies are regulated and audited around the world. PwC could face a problematic start of the year as Satyam is listed in the US, where there are legal precedents for auditors held accountable.

The stock market is highly volatile these days and we can hope that such news of financial overstatement will be exposed in the climate of asset liquidation and institutions filing under Chapter 11.

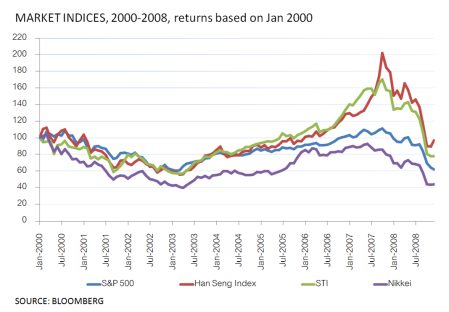

The stock market has always been volatile. In fact, referring to the graph below (click the image to have a clearer version), the stock market price as embodied by major stock indices, exhibits variation that is not only unpredictable but also random in itself. The randomness can be attributed to its susceptibility to news, rumors, political instability and mass panic. The recent Satyam hoo-hah serves to demonstrate the effect such a scandal can have to the stock market; The Mumbai exchange’s benchmark Sensex index fell 7% as shares in Satyam plummeted nearly 80%.

We at Assetton believe in the importance of economic fundamentals and clear-cut rational principles. Our investment-grade wines, contemporary pieces of art from the Baron of Batik, and bankable lands in Canada follow real economic principles. You can be sure that the intrinsic value of these assets is not inflated by tampered financial statement.

Sunday, January 4, 2009

Bordeaux: A trip to the land of fine wine

Bordeaux wines are the most extensively tracked wines in the world because of their importance to the market. The wines are rated three times before they ever reach the consumers, twice before the wines are bottled.

Bordeaux wines are the most extensively tracked wines in the world because of their importance to the market. The wines are rated three times before they ever reach the consumers, twice before the wines are bottled. The name Bordeaux is synonymous with wine investments. This is attributable with the rich history and strategic location of the region. Red Bordeaux wine has an established resale past and is primarily the investment medium. Red Bordeaux remains the leading investment grade for wine auction prices. Also, the value of a Bordeaux wine is more readily identifiable, the 150-year old 1855 classification providing a framework for evaluating wine most widely held and traded.

Through centuries, the top Bordeaux wines have proven an exceptional ability to live long lives. IT is the foundation of their attractiveness among consumers and the foothold of their success among investors. A 50-year-old Bordeaux are as young and vibrant today as the day they were released. Bordeaux’s amazing ability to age enables investors to trade these wines repeatedly, from collector to investor, to finally an end consumer who is willing to pay up for a distinct rarity of the best Bordeaux.

The longevity and predictability of Bordeaux give collectors and investors the conviction that young wines will age gracefully and be worth more in the future, and gives them the confidence to buy and hold other vintages, knowing that they will improve in flavour and appreciate in price. History has shown that investment-grade Bordeaux dependably trends higher with the passage of time. Ultimately, no other region can be proud of so many wines that possess both the longevity of Bordeaux and the huge, established market for back-vintage wines.

As a result, as of 2008, the 118 Bordeaux chateaux account for 90% of the entire dollar volume in the investment-grade wine market, which includes the finest wines from every other region in the world. Amazingly, 25 of Bordeaux best chateaux account for approximately 80% of the dollar volume in the industry.

In fact, the new index Liv-ex Claret Chip Index, that is comprised of only the best, the Bordeaux Left Bank First Growth, has outperformed not only the Liv-ex 500 and Liv-ex 100 indices, but also the S&P 500 and FTSE 500 indices. This is evident in the graph showing the relative prices of the mentioned indices below.

Source: David Sokolin and Alexandra Bruce’s Investing in Liquid Assets: Uncorking Profits in Today’s Global Wine Market,

LAND INVESTMENT: Canada

For hundreds of years, vast fortunes have been made in land. It can often be purchased extremely cheaply, and with little or no effort at all it can bring a return that is multiple times its original investment cost. There are more benefits -

• Buying land is usually a good deal compared to buying developed real estate.

• Purchasing land offers flexibility for the buyer. Depending on area zoning, land can be used for multiple purposes and have higher potential value.

• When you invest in land versus rental properties, there is no need for one to devote time, money, and effort to the maintenance of property or attracting and keeping a steady stream of reliable tenants.

• Returns on real estate investments in land can be substantial if you do your homework and invest where the demand is high or will be high in the near future. For instance, appreciation is almost guaranteed when land is purchased on the outskirts of a city in the path of development and held until the city develops outwards.

• The market for second homes and vacation homes is booming, and buying a lot or land is the first step to building a second home for investment, pleasure, or retirement. When new developments open, there are often good deals for early buyers who invest in lots before construction begins.

In Asia, land investment has been increasingly popular. Because land is fundamentally considered indestructible, there’s no depreciation allowed for tax purposes. Investors can potentially achieve annual net returns of as high as 20 per cent on their investments when the raw land obtains development approvals and they exit their investments in five years or less.

Land investment is especially attractive to those who have a medium to long-time horizon and with already sufficient savings to satisfy their liquidity needs. A good diversifying asset to complement the traditional asset classes of equities, fixed income, cash or cash equivalents, one should form at most a small component of an investor’s portfolio, say, 5 to 10 per cent on land.

The most promising are those with good location. Investors should apply similar standards of reviewing real estate investments to a land banking investment. Investing in raw land brings its best return when the land lies along a path or near an area of expanding economic growth and prosperity. Increases in land value are always dependent upon the land’s future use, economic growth, and demographics, which all boil down simply to the fundamental laws of supply and demand.

Consumers have to be mindful that those who had invested in land banking projects had benefited from the bull run in various asset classes over the five years to 2007. Hence, some projects marketed could have delivered high returns. Such projects rode on the appreciation of the Canadian dollar and the real estate sector. For instance, the Canadian dollar has appreciated about 50 per cent against the US dollar since 2003.

Another advantage of land banking is that it is a medium- to long-term investment, so consumers may be able to avoid the constant worrying they experience when they invest in financial markets.

Assetton provides the opportunity for you to invest in the prime land in Alberta, Canada. Alberta has shown tremendous popularity with investors, business and job-seekers. Assetton and its team researches, evaluates and purchases developable land that is in the direct path of urban growth. We ensure all necessary steps are taken to protect and yield the highest rate of return for our investors. Our exceptional price point and opportunity have made investing in developable land easy and exciting for every investor.

Source:

Smart Investor, Straits Times, Financial Web

Monday, December 29, 2008

FEATURED ARTIST: SARKASI SAID

Batik is a form of fabric art where melted wax or malam, is applied to cloth before dipped in dye. This art is associated closely with the Malay people. Yet, many are not aware that batik has a very universal appeal and is an established art form in China, Japan and India. The Malays have used batik in their own unique ways. The renowned batik extraordinaire Sarkasi himself puts it, “A Malay uses batik from the time of his birth to the time of his funeral.” Different types of batik have their individual stories and purpose. In Indonesia, the Batik Larangan (Forbidden Batik) is still the exclusive domain of the Javanese royal house.

His accolades are numerous. In 1974, he won the Pingat APAD, from Angkatan Pelukis Aneka Daya or APAD, a local art group for his contributions to the development of art. This was followed by a string of other awards, including: Best Foreign Entry Sarasota Art Society (USA) in 1981, the First Prize -Abstract Category for The 8th UOB Painting of the Year Award in1989, and Highest Commendations in the IBM Art Award in 1990. More recently, he holds a record in the Guinness Book of Records of having painted the world’s longest Batik painting of 103.9 metres.

Mr Said has also contributed to numerous charitable events. Throughout his eminent art career, Sarkasi has held numerous exhibitions to showcase his works in countries including Singapore, New Zealand, Indonesia, Japan, Malaysia and the United States.

The idyllic kampongs and the Botanic Gardens became Sarkasi’s workshop where he developed his distinctive style that is closely linked with the world of nature. With graceful brush strokes, Sarkasi effortlessly captures on canvas the beauty and wonders of this world with a celebration of exuberant and lively colours, developing a pictorial language that is both distinctive and compelling. It is a vision in which nature and artifice are entwined and which appears to promise images symbolising continuous metamorphosis.

Sarkasi employs colour in order to convey splendour and radiance. And he does so with the full confidence in the capacity of colour to invoke optimism, vivacity and energy. His artistry is firmly rooted in the conviction that art and nature are connected and are mutually inter-reliant.

Assetton is offering a limited number of original Sarkasi Said works of art. Each piece is an original work of art. The 5 themes are: Mother & Child, Floral, Kampung, Abstract and Urban Landscape. No limited editions, prints, lithographs, etc.

Tuesday, December 23, 2008

2008 round-up of the wine industry

Wine trading is increasingly popular as shown by the fact that the Liv-ex Fine Wine Exchange had a strong year, with trade up 78% on 2007. Trade was again dominated by the Bordeaux First Growths.

Wine trading is increasingly popular as shown by the fact that the Liv-ex Fine Wine Exchange had a strong year, with trade up 78% on 2007. Trade was again dominated by the Bordeaux First Growths.Trade in Bordeaux was concentrated on the 2000 and 2003 vintages (accounting for 23% and 20% of trade respectively) as some of the top names turned over at reduced levels. Interestingly, trade in 2005 also increased significantly, as recent price falls of as much as 30% encouraged buyers to step in. The vintage’s 15% share of turnover was the highest we have seen since the heady days of June.

The Asian market has shown optimism despite the economic downturn. In Japan, the recent strength of the yen is a push-factor that enables Japanese to buy from Europe with less. Wine shops cleverly advertised this as one very good reason for wine lovers in Japan to buy now. Consumption continued although in a less public manner.

A new breed of rich investors and wine drinkers in China, India and Russia have sent en primeur prices so high, even bypassing the influence of the Robert Parker scores.

The tax on imported wine in Hong Kong was scrapped in March, after dropping from 80% to 40% last year, further boosting Asian demand. More specifically, there seems to be an apparent valuation paid to the brand than the quality. Lafite, for example, is particularly popular in China because of its status.

Assetton is a company that deals with wine investment on the widely-tracked wines from Bordeaux, France. We primarily trade the region’s First-Growth wines that have the best wine-growing potential, including Haut Brion, Lafite Rothschild, Latour, Margaux and Mouton Rothschild. These are the most sublime, sought-after luxury goods in the world, with the most solid, bankable track record.

Sources

Liv-ex December 2008 Report

The Impact of Credit Crunch on the Asian Fine Wine Market, from eRobertParker.com

‘Buyers and Cellars’, The Economist

The Henley Centre, Consumer Research Unit

‘The Grapes of Math’ from Investing in Liquid Assets by David Sokolin and Alexandra Bruce